Public Equity Performance

- After reaching all time highs at the end of November and early December, both the S&P 500 and NASDAQ have traded off 3.8 and 3.9% since the end of last month, respectively. That being said, since the end of last year, last quarter, and last month, the average colocation and hosting equity has outperformed both the S&P 500 and the NASDAQ.

- Year to date, DFT has been the best performing publicly traded colocation/hosting equity with a share price appreciation of 36.4% versus 7.6% for the S&P 500.

- Quarter to date, RAX has been the best performing publicly traded colocation/hosting equity with a share price appreciation of 19.2% versus 0.9% for the S&P 500.

- Month to date, DFT has been the best performing publicly traded colocation/hosting equity with a share price appreciation of 3.4% versus -3.8% for the S&P 500.

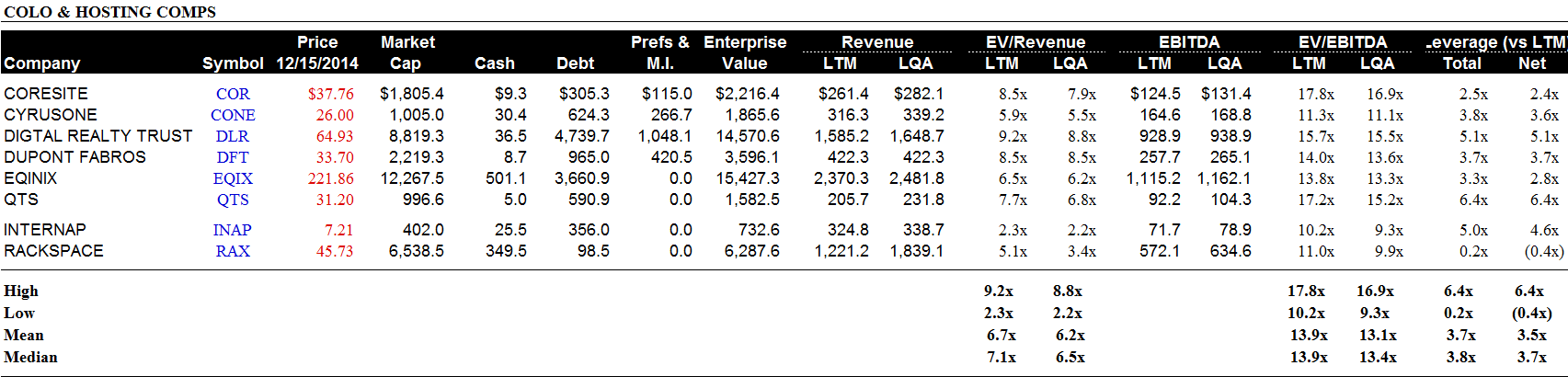

Public Equity Valuations as of December 15, 2014

- Market Cap

- As might be expected of the sector leader, EQIX had the highest market cap in our universe of publicly traded hosting and colocation equities.

- Enterprise Value (EV)

- As might be expected of the company with the highest market cap, EQIX also had the highest Enterprise Value in our universe of publicly traded hosting and colocation equities.

- EV/Revenue

- The companies in our coverage universe averaged an EV/LTM Revenue multiple of 6.7x and an EV/LQA Revenue of 6.2x.

- The companies in our coverage universe had a median EV/LTM Revenue multiple of 7.1x and a median EV/LQA Revenue multiple of 6.5x.

- With an EV/LTM Revenue multiple of 9.2x and an EV/LQA Revenue multiple of 8.8x, DLR was the most highly valued company in our coverage universe.

- With an EV/LTM Revenue multiple of 2.3x and an EV/LQA Revenue multiple of 2.2x, INAP was the least valuable company in our coverage universe.

- EV/EBITDA

- The companies in our coverage universe had an average EV/LTM EBITDA multiple of 13.9x and an EV/LQA EBITDA multiple of 13.1x.

- The companies in our coverage universe had a median EV/LTM EBITDA multiple of 13.9x and a median EV/LQA EBITDA multiple of 13.4x.

- With an EV/LTM EBITDA multiple of 17.8x and an EV/LQA EBITDA multiple of 16.9x, COR was the most highly valued company in our coverage universe.

- With an EV/LTM EBITDA multiple of 10.2x and an EV/LQA EBITDA multiple of 9.3x, INAP was the least valuable company in our coverage universe.

- Leverage

- The companies in our coverage universe averaged Total Debt/LTM EBITDA of 3.7x.

- The companies in our coverage universe had a median Total Debt/LTM EBITDA of 3.7x.

- With Total Debt/LTM EBIDA of 6.4x, COR was the most highly levered company in our coverage universe.

- With Total Debt/LTM EBITDA of 0.2x, RAX was the least levered company in our coverage universe.

Note:

- EV = Equity Value + Total Debt – Cash

- Net Debt = Total Debt – Cash

- LTM – Last Twelve Months

- LQA – Last Quarter Annualized

Other News

- Access Group to Acquire Cloud Hosting Provider StratoGen. Access Technology Group (Access) has acquired cloud hosting specialists StratoGen. The move gives Access hosting capabilities to support ongoing growth of its SaaS and cloud suite of products. StratoGen has over 150 customers and has revenues of ~£4 million.

- Apollo Global to Buy IT Solutions Provider Presidio Holdings. Apollo Global entered into a definitive merger agreement to acquire Presidio Holdings from American Securities. Terms of the transaction were not disclosed. Presidio is a premier IT infrastructure solutions provider for approximately 6,000 clients across the United States. Aided by the expertise of its nearly 1,200 engineers, Presidio assists clients in designing, procuring, implementing and managing IT infrastructures that deliver tangible business value.

- Iron Mountain and Seagate Partner to Offer Secure Cloud Server Backup, Disaster Recovery Solutions. Iron Mountain and Seagate Technology announced a multi-year alliance agreement that brings together distinct capabilities in security, services, and scale from two industry leading information storage and management companies. Seagate will co-locate parts of its data center operations to Iron Mountain’s National Underground Data Center. Additionally, Iron Mountain will resell Seagate EVault Cloud Server Backup and Cloud Disaster Recovery solutions.

- Threatstream lands $22 million in Series B funding led by General Catalyst Partners. Threatstream, the provider of a threat intelligence platform that identifies cyber threats and facilitates trusted threat sharing, today announced that it has raised $22 million in series B funding led by General Catalyst Partners, with significant investment by new investors Institutional Venture Partners and previous investors Google Ventures and Paladin Capital Group.

If you enjoyed this post, make sure you subscribe to my RSS feed!

Leave a Reply

You must be logged in to post a comment.